30Jan2021 –

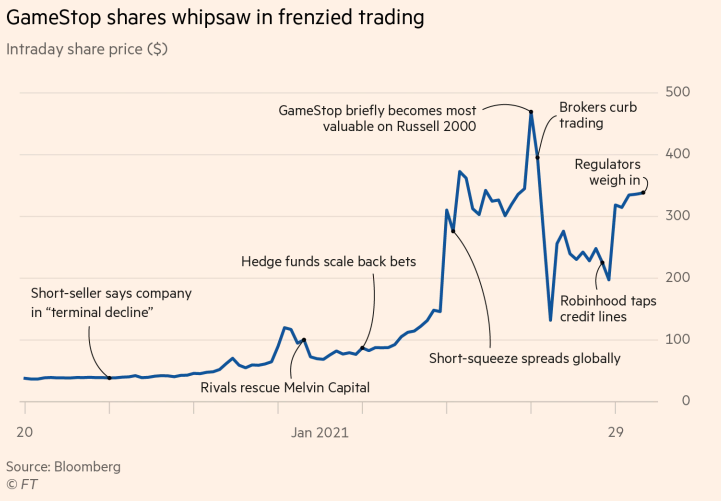

Much has been published on the war between retail investors taking on hedge funds who are short stocks like GameStop and AMC. Speculators serve a function of facilitating price discovery, both long and short alike. Though the process, is seldom smooth (if ever), they are still a vital part of the market. Speculators take a position when the perceived rewards outweigh the calculated risks involved. Shorting a stock is inherent risky because of the unlimited loss that could be incurred as compared to a long position which is restricted to the notional value invested in the purchase. The short squeeze sparked by retail traders’ long call positions is simply forcing the shorts to re-assess these risk matrices.

Morality and political affiliations aside, this is the brutal laws of the financial market’s jungle functioning the way they are designed to be. Markets will always tend to squeeze crowded trades regardless of the direction. With 140% of outstanding free float being shorted, GameStop was a crowded short trade waiting to be squeezed. This is not the first time this has happened. Back in 2008 Volkswagen (VW) stock quadrupled and spiked to EUR1000 after Porsche announced an audacious takeover. But the real driver then was that the market quickly realised that the short positions is more than the total free float of the VW stock available in the market.(Shorting auto stocks were used as a proxy to short the market during the Lehman crisis as regulators banned the shorting of financial stocks)

It is safe to say that most (if not all) the buyers of GameStop and all the related short squeeze trades are speculative in nature. Therefore, a strong word of caution to all the newly empowered retail traders, there are risks to this trading strategy even if it is executed via options.

Firstly, although the long call positions limit the downside to just the premium paid, most of the call positions are also leveraged. The online broking houses are the ones funding these call positions for a nominal amount of initial margin paid upfront by the retail trader. The cost of this funding will most likely be increased or the leverage can be totally removed as the market volatility (and risks) increased exponentially. We are already seeing this happening.

Secondly, this is no longer a cheap punt unless one has entered at the very early stage. The spike in both the underlying stock price and volatility have made the premiums cost of such calls daunting. As the point of writing this article, a 1-week at-the-money call option on GameStop trades at nearly 50% of the underlying share price! (share price = 312, 1wk call option with strike at 312.5, the premium = $128). Long options face a negative time decay. i.e. you lose money every day as the option gets to expiry, ceteris paribus. Hence, you will lose all your premium if the options expire out-of-the money.

Lastly, in any trade strategy, there must be an exit plan. One obvious way to exit is to sell (either the call itself or exercise the call, assuming it is in-the-money, and sell the underlying stock) when the shorts are desperately covering. However, that short covering will eventually subside. At that point, the stock’s fundamentals will start to kick in. While everyone is calling for the stock to go to the moon, for those that had been there, they will be quick to tell you that the moon is pretty much an empty place. The price of one tulip bulb is equivalent to the price of a Renaissance painting at its peak during the tulip bubble. Such a trading strategy requires the “next better fool” to take over your position. The market price and liquidity might not be there for you to close your position.

A bubble is a bubble no matter how you like to call it. Every generation needs to learn their own lesson in terms of bubbles. From tulips to dot com to the housing bubble in 2008. Nothing has changed because we humans as a species have not. The fundamental greed and fear emotions are part of our biological setup. As a particular generation learns its own lesson and get wiser, the next generation will need to re-learn the same lessons. This is simply because such wisdom cannot be truly gained by reading history books and a change of the context will always make people believe that “this time it’s different”. True experience can only be gained by going through it yourself. These are also the reasons why history keep repeating itself and bubbles will always be reappearing. Hence, enjoy the ride but do not be Johnny come late and be the last one holding the hot potato.

#bubbles #trading #ShortSqueeze #gamestop

https://www.pzhconsultants.com/disclaimer. html

Chart from Financial Times