MEET OUR PROFESSIONAL MEMBER

Thomas Poh

“It is easy to complicate something simple.

The challenge is to simplify something complicated.”

www.pzhconsultants.com

Thomas is the Founder and Managing Director of PZH Consultants. He is an accredited trainer in financial markets products where he partners with leading financial institutions and universities including CME Group, ACI Singapore – the Financial Markets Association, Association of Financial Professionals (AFP), National Technological University of Singapore (NTU) and Singapore Management University (SMU). He is also a transformation management consultant to corporations and a professional member of Asia Professional Speakers Singapore (APSS).

Thomas has over 20 years of Financial Markets experience as a trader and had risen through the ranks to hold senior positions in global and leading regional banks. He started his career with Citibank under the Management Associate program in 1997 before joining other global banks such as ING (2000-2003) and HSBC (2003-2004). In 2004 he was back with ING Singapore’s Emerging Markets trading team where he subsequently held the role of Managing Director, Head of Emerging Markets FX & Rates Asia. As the Head of Trading in Techcombank, Vietnam, he successfully transformed the local trading team into what is widely regarded as the best trading team in the country. In 2016-2018, he was heading the Strategic Management Desk with UOB Singapore where he is responsible for strategic trading positions taking and advises ALCO on their hedging decisions.

Throughout his career, he had built and transformed various trading platforms. Such actual ground experiences have honed his training and coaching skills. The understanding of his audience is the cornerstone for his training designs. Being an Emerging Markets products specialist with a global exposure, also allows him to leverage on his strong understanding of the many diverse cultures during his training. He likes to shares his personal anecdotes and other real-life experiences in order to make his training sessions practical and interesting.

Thomas’ passion for training comes as a way of giving back to the community. He had recognised the invaluable benefits that he had gained from his mentors’ coaching during the early days of his career. His personal goal is to try to make a positive difference to the lives of people that he meets. His training audience spans across external clients, fellow industry peers and his banks’ internal staff. Many of those had since risen to become leaders of their own.

Follow me on

Contact me

[email protected]

Latest Articles

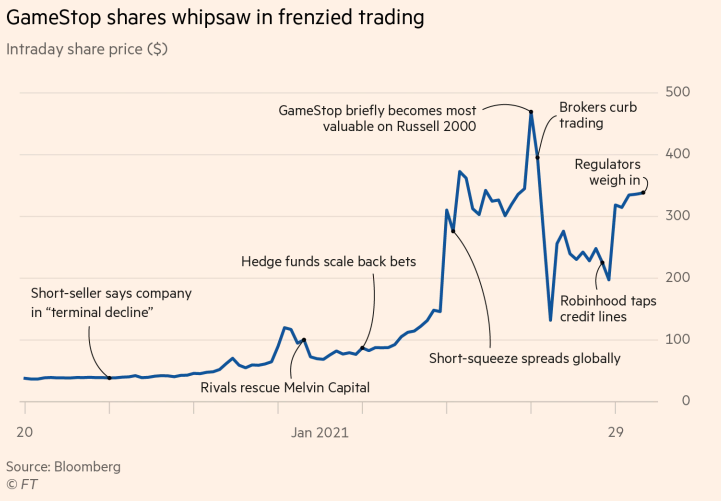

Be careful when flying to the Moon

Published on 07/13/2021 under Finance

30Jan2021 – Much has been published on the war between retail investors taking on hedge funds who are short stocks like GameStop and AMC. Speculators serve a function of facilitating price discovery, both long and short alike. Though the process, is seldom smooth (if ever), they are still a vital part of the market. Speculators […]

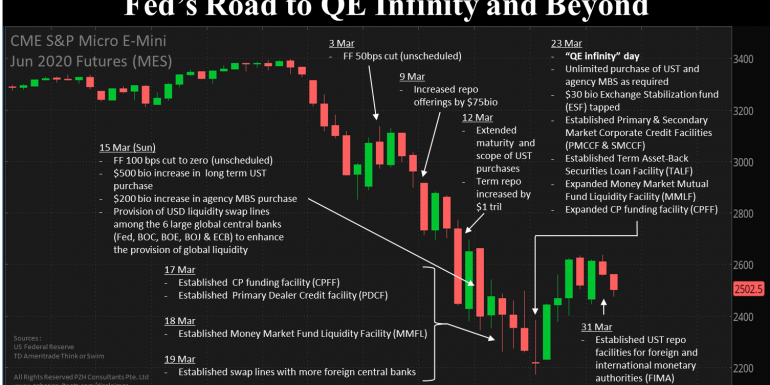

Fed’s Road to QE Infinity and beyond

Published on 04/28/2020 under Finance

Fed’s Road to QE Infinity and beyond By Thomas Poh Market Dislocation amid COVID-19 Outbreak The COVID-19 outbreak has hit the world like a hurricane. The ongoing medical and humanitarian crisis has also sparked off an economic and financial one. As the world realised that the virus knows no borders, global financial markets tanked. The […]

My ACTA Journey

Published on 12/30/2019 under Presentation Skills

12 July 2019 – CHICAGO! That is the code word for any Learner who has successfully achieved COMPETENCY which is what most of us would call a “Pass” for the Advance Certificate for Training and Assessment (ACTA). (For those that need to know, the alternate scenario is Not Yet Competent… … ) Yes, it has been quite […]

SOFR & Overnight Repo Spike

Published on 12/30/2019 under Presentation Skills

18Sep2019 – Thomas Poh The recent spike in USD overnight repo rates is widely attributed to US corporate tax payment activities as well as the reduction in the Fed balance sheet which resulted in subsequent reduction in US banks cash reserves. As result, the Fed had to inject USD 75bio into the overnight market more than once […]