Fed’s Road to QE Infinity and beyond

By Thomas Poh

Market Dislocation amid COVID-19 Outbreak

The COVID-19 outbreak has hit the world like a hurricane. The ongoing medical and humanitarian crisis has also sparked off an economic and financial one. As the world realised that the virus knows no borders, global financial markets tanked. The longest stock market bull run in history ended in the most dramatic fashion as the S&P 500 lost as much as 34%, at its lowest point, on 23rd March.

As countries go into lockdown and the stock market went through a tsunami-styled selloff, secondary tremors were immediately felt across all other asset classes. These asset markets went through huge (some unprecedented) market dislocations, driven by one major common theme, FUNDING. Leading bond ETFs were trading at deep discounts against their NAVs and the USD index rose by almost 9%. The three-month Libor jumped 16bps on 17th March 2020 while the price of Jun 2020 futures indicated Libor vs SOFR spread to be as high as 57 bps at maturity. At one stage, the market even started to sell treasuries and gold simply to raise cash, ignoring their usual flight to safe-haven assets.

The COMEX gold futures market also witnessed a short squeeze caused by a shortage of gold bars available for physical delivery. The chaos and fear in the market forced the US Federal Reserves (Fed) to pull all stops and implement its own “shock and awe” measures to calm the panic.

Fed’s Life Raft(s) to a Dislocated Market

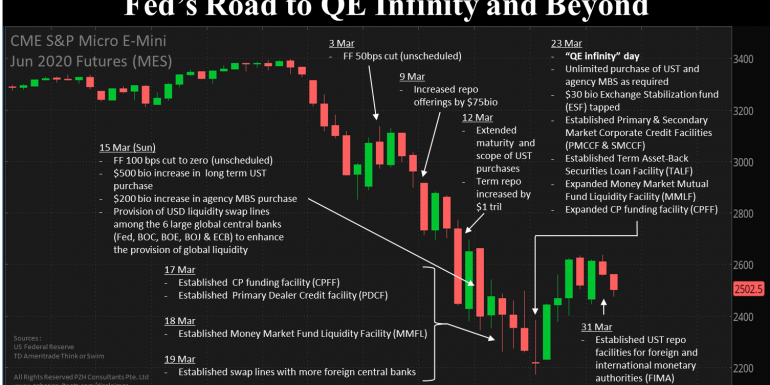

Exceptional times call for exceptional measures. The Fed had been monitoring the situation of the outbreak on the onset. Up till mid Feb, Fed Chairman Powell still maintained the FOMC’s neutral view on the economy while delivering his testimony statement to the US House of Representatives. All that changed quickly when the escalation of the outbreak triggered the first wave of selloffs in the asset markets mentioned earlier. The Fed responded on 3rd March with an unscheduled 50bps cut in Fed Fund rate. As the crisis continued to worsen, the Fed began throwing everything and ultimately the proverbial kitchen sink into their efforts to restore calm in the markets.

The Fed’s measures focused mainly on injecting liquidity into the financial system. More importantly, they had realised that even though Fed Funds were ultimately cut to zero on 15th March, the liquidity was still not getting to where the forest fires were burning the fiercest. The deep fault lines running underneath the funding market, which were first uncovered when the overnight repo rates traded to an intraday high of 8.5% in September 2019, began to wreck more damage. In reminiscence of the global financial crisis of 2008, an alphabet soup of schemes was subsequently announced over the following weeks. Liquidity was injected into mortgage backed securities (TALF, ESF), commercial papers (CPFF), money market funds (MMLF), and corporate papers (CPFF, PMCCF, SMCCF) (see chart below). In addition, USD swap lines and even treasury repo facilities were arranged for foreign central banks (FIMA Repo Facility). The Fed’s measures literally transformed itself from the lender of last resort for banks, to the lender of last resort to the world.

On 9th April 2020, the Fed announced another $2.3 trillion lending plan in support for the American economy, most notably to the high yield corporate debt market and small and mid-sized businesses.

Is it enough?

The Fed, together with their global counterparts, has reacted swiftly and decisively in this crisis. From the price action of asset markets observed since the announcement of QE Infinity, it does seem that the market had found a temporarily footing.

However, from an economic perspective, the financial market shock, demand shock and supply shock all happening at once in this crisis. With rates previously already hovering at the low end and now at zero, the ability of the Fed to alleviate the latter two will be limited. The heavy lifting will have to come from the emergency fiscal measures that are being announced globally. As it stands, USD 5 trillion have been pledged by G20 countries thus far. Unlike the Global Financial Crisis of 2008, politicians do not face any moral hazards this time round. Fiscal flood gates have been opened and will stay open for as long as they are necessary, in order to alleviate the economic repercussions arising from the lockdowns and social distancing.

We are assured that both fiscal and monetary measures are firing on all cylinders globally. However, there is still a great uncertainty with regards to the success of the individual countries’ containment efforts as well as the timing towards the discovery of a vaccine.

While we pray for the day where the world declares victory in our fight against the epidemic, the uncertainties in the financial markets will continue to translate into volatility and opportunities.

Trade Ideas

1. Treasury futures back as a safe- haven trade

The raft of measures adopted by the Fed seems to have taken effect in restoring calm to the market. US Treasuries (UST) have since regained their safe haven status, re-establishing its negative correlation with equities price movements.

However, US jobless claims from mid-March to 8th April showed a staggering total of 16 million people filing for unemployment benefits, according to the US Labour Department. This is clear evidence that while the Fed has restored the plumbing in the system; the bitter reality of the economic slowdown is only starting to show.

Although UST yields are at historical lows, there is still room for them to head lower in the short term, given that more negative economic data is expected ahead and the short end is now firmly anchored at zero by the Fed. The prices of 10-year T-Note futures (ZN) should make new highs (new low in yields) if the stock market breaks down from its current consolidation phase.

The key here is to buy ZN only on dips (when yields spikes) as prices gyrates in this volatile market environment. Stagger your entry levels and sizes and let the market come to you.

2. 10-year vs 30-year yield curve steepens via futures

While the USD 2 trillion relief package has met the market’s expectation, this has put the total US fiscal spending to over 10% of US GDP. Someone will need to pay for the bill at the end. The market has pushed the spread between the yields of the 30-year and the 10-year Treasuries to a high of 65bps on the back of this fiscal deficit concern.

This steepening trend should continue and eventually break higher. We can express this UST curve steepening trade by selling the 30-year T- Bond futures (ZB) and buying the 10-year T-note futures (ZN) on a duration neutral basis. By using futures instead of cash bonds, we could stay away from tapping into the repo market for funding. The almost round-the-clock trading hours of the UST futures market will also allow us to better manage our risks in these volatile markets.

A duration neutral spread trade can be easily executed via Inter-commodity Spread (ICS) which are listed on the platforms of independent software vendors (ISVs). This allows traders to efficiently execute any futures spreads trades in duration hedged amounts on the individual legs. Any residual risk amounts can be squared via outright Treasury futures. (More references can be obtained here)

3. Funding pressure to subside and Libor-SOFR spread to converge

The Fed will start purchasing commercial papers via the Commercial Paper Funding Facility (CPFF) on 14th April 2020. Together with all the other measures, we would expect the elevated Libor rates to start retracing soon. The historical average between 3-month Libor and SOFR is approximately 20bps. We can express this view by buying ED futures (EDM0) and selling 3-month SOFR futures both maturing in Jun 2020 of equal notional amounts.

This can also be executed as an ICS. The spread can be viewed on CME’s STIR analytics tool and executed via listed ICS on ISVs.

Finally, I would like to offer a prayer to everyone that is fighting the disease. A salute to the men and women on the front line that are helping us to contain the spread, the medical staff that are literally risking their lives with every breath they take.

This too shall pass.

Disclaimer: www.pzhconsultants.com/disclaimer